The company allows you to link your Chase checking account directly to your Chase savings accounts, with an easy-to-use mobile app for checking balances and paying bills. You need at least $300 in the account ($15,000 for premier) to avoid paying a maintenance fee.

Best Overdraft Protection |

How We Found The Best Checking Account

8 common fees compared

- April 26, 2018 - We've updated our top picks to reflect the 2018 checking account landscape. Capital One and Discover remain favorites, but our new overall top pick is Ally Bank.

The Best Checking Accounts

We looked at 35 nationwide banks or online checking services, digging into the numbers and fine print to uncover the best checking account for every lifestyle. We dinged banks with less-than-stellar customer service and unnecessary fines hidden within the fine print (like maintenance costs and dormancy fees). Our top picks make it easy to access your money and reach a human when you need assistance.

The Three Best Checking Accounts

- Ally Bank -

Best Customer Service

- Capital One -

Best Overdraft Protection

- Discover Bank -

Best for Earning Cash Back

Ally Interest Checking Account

Ally Interest Checking Account

Customer service

Earns interest

Low monthly fees

Why we chose it

Customer service

We weren’t surprised when Ally Bank, our top pick for the best bank, also clinched the top spot for checking accounts - and a lot of its success has to do with its customer service. With representatives available 24/7, you can choose to contact customer support via phone, email, or live chat. When we called late at night with a customer service request, Ally reps sound surprisingly pleasant and eager to help.

The Ally mobile app also makes it easy to deposit checks, transfer funds, or check your balance from anywhere and at any time. For reference, just take a look at the app’s 4.8 ratings on the App Store and 3.5 ratings on Google Play — it’s safe to say most people agree on Ally’s reliable app and customer service.

Earns interest

Most banks only offer interest accrual on savings accounts, but Ally stands out as an exception. You can earn 0.1% back in interest on daily checking balances under $15,000 and 0.6% on balances over $15,000. This means you could earn $10 for carrying a daily balance of $10,000 and $120 for a $20,000 balance over 12 months.

Low monthly fees

On top of not making you worry about a monthly maintenance fee, Ally bank also has the lowest fines of our top picks. If you overdraw your account and haven’t connected an Ally Online Savings or Money Market account from which to draw, you’ll be charged $25 no more than once per day (versus the $30-$35 charged by Discover and Capital One). Ally Bank’s domestic outgoing wire transfer fee is also just $20, as opposed to Discover and Capital One’s $30 charges. And if you make a lot of withdrawals on the go, Ally offers $10 per statement cycle to reimburse any out-of-network ATM fees you might incur (although it does have over 43,000 fee-free ATMs in the U.S.)

Points to consider

International transaction limitations

Ally Bank is a strong choice for domestic banking, but if you travel frequently or have financial obligations in other countries, you should be aware of a couple drawbacks. To start, Ally doesn’t allow outgoing international wire transfers — you’ll need to use a different bank to send money abroad. Additionally, Ally charges a 1% fee on all transactions and withdrawals made abroad with your debit card, and this is on top of any currency conversion fee that might occur. If you’re looking for a checking account you can use globally, we recommend taking a look at Capital One’s 360 account or the Discover Cashback Debit account instead.

Capital One 360

Capital One 360

Overdraft options

Travel incentives

Earns interest

Customer service

Why we chose it

Overdraft options

Unlike other banks, Capital One automatically defaults to “auto-decline” if you overdraw your account. This means that if you’re about to spend more than you have in your checking account, Capital One simply won’t let the transaction complete. It sounds harsh, but it could actually save you some money over time. However, this is just one option of four — you can choose to have funds automatically withdrawn from your savings, pull a line of credit (on which you’ll pay interest), or you can opt for its next-day grace program, which gives you a full 24 hours to pay your debt before Capital One hits you with a $35 fee.

Travel incentives

We appreciate how Capital One caters to frequent travelers — you can use your debit card anywhere you see the MasterCard logo without having to worry about a foreign transaction fee. To compare, Ally charges you 1% of the foreign transaction, even when you use it at an Allpoint ATM. Discover, on the other hand, doesn’t have restrictions on use at participating locations in Canada, Mexico, and the Caribbean — but it might charge you in other areas.

Earns interest

Like Ally, Capital One offers interest earnings with its checking account, although the rates vary. The APY varies based on your balance: 0.20% if it’s $49,999.99 or less; 0.75% if it’s between $50,000 and $99,999.99; and 1.00% if its $100,000 or more. Not sure which benefits you? Ally’s interest rates are best for checking accounts with balances between $15,000 and $49,999 — if your account has less than $15,000 or more than $50,000, you’ll get better interest rates from Capital One.

Customer service

Capital One did well in our customer service test, but it also offers a unique approach to your average brick-and-mortar experience on top of its online services and highly-rated app. For those of you who prefer physically speaking to someone as opposed to virtually or by phone, Capital One gives you a casual platform to do so with its “Capital One Cafe.” While there, you can seek representatives to answer all of your financial questions or just enjoy a cup of coffee — regardless of whether you’re a customer. Do note, though, that these locations are currently only in major cities.

Points to consider

Steeper fees

Our other top picks issue cashier checks for free and also give you new boxes of checks for free – Capital One charges you $20 and $5, respectively. Additionally, Capital One’s fines tend to be higher. If you do have a check bounce ($9), or make frequent wire transfers (outgoing domestic: $30), you’ll spend more in fees with Capital One than with Ally or Discover.

Discover Cashback Debit

Discover Cashback Debit

Cashback perks

Foreign transactions and transfers

Fee forgiveness

Why we chose it

Cash back perks

Discover Bank offers checking customers a cashback rewards system rather than the interest-bearing accounts of Ally and Capital One. With a Discover debit card, you can earn 1% cash back each month on up to $3,000 in qualifying purchases. You’ll be able to earn up to $360 per year. By comparison, at Ally’s highest interest rate, you’d need $60,000 in your checking account to earn $360 annually (and you’d need at least $50,000 with Capital One).

Foreign transactions and transfers

Discover won’t charge you a foreign transaction fee if you use your card at a participating location in Canada, Mexico, and the Caribbean. Like Capital One and Ally, Discover doesn’t charge a fee if you receive a wire transfer in U.S. currency from a bank overseas — but Discover also doesn’t limit you to incoming international wire transfers — it actually allows you to initiate them (for a $30 price tag). So if you have financial obligations overseas, Discover has you covered.

Fee forgiveness

There’s no need to fret over your first experience overdrawing your account or needing a stop payment — Discover will waive your first fee. Plus, if you happen to lose your debit card or need more checks, Discover won’t charge you for those either. Knowing you have a slight buffer after opening your account might help incentivize healthy account behaviors for the future, and we appreciate the leniency.

Points to consider

Overdraft protection limitations

The great thing about Discover’s overdraft protection service is that as of June 16, 2019, it's free — you'll never be charged a fee for insufficient funds (if your linked savings or money market account doesn't have enough funds to cover a purchase, either, the payment will just be declined). But Discover will only transfer funds if an externally-initiated transfer or bill payment causes the overdraft. If you set your bills to auto-pay and one of them causes an overdraft, for example, that overdraft will be covered. However, if you go to an ATM or use your debit card and cause an overdraft, Discover’s overdraft protection service won't kick in (instead of pulling from your linked account, the transaction will just be declined). If you don’t normally keep a lot of cash in your checking account, this means you might have to keep a closer eye on your checking account after bills have been processed.

Guide to Checking Accounts

Know where you want to put your money

It’s best to plan financial decisions in advance and strategically place your money into your checking, savings, or elsewhere, before spending haphazardly. Deciding how much to keep in your checking account versus your savings account depends on your spending habits and risk tolerances. But it’s largely a question of where your money will do you the most good in the long run.

Be aware of account upkeep

As previously stated, some banks will charge you for inactivity. And “inactivity” can have different meanings for different banks. We did the vetting for you — all of our top picks come without the extra baggage of monthly maintenance fees and entrance deposits. Some banks, like Bank of America, however, have restrictions on how much money you keep in your account every month — if you fall below the limit or don’t meet the mark one month, you’ll be hit with a $12 charge.

Think about your savings

Being able to financially prepare for the future helps boost an overall sense of wellbeing, but it can be difficult to know exactly how much should go into your savings. Experts recommend three to six months’ worth of expenses for your emergency stash, but for retirement and other long-term planning, consider consulting a financial advisor.

Consider linking your checking and savings

While it certainly isn’t required to place your checking and savings money into the same hands, it could be more convenient, especially when it comes to making transfers and overdrawing on your checking. If you have your checking in one place and savings in another, you will have to wire money between banks to make transfers, and this could take more time. But, if you like the APY offering of one savings account (Ally is now at 1.90%) and the overdraft options of another (Capital One), for example — the choice is yours to bank with both.

If you can predict how much you’ll make and spend for the next few months with confidence, you have a stable job and consistent spending, you might only need three months’ expenses in a savings account. This might also give you some room to invest the rest of your earnings in higher interest accounts like 401ks, mutual funds, IRA accounts, or investments with stock markets and lending clubs. But if you have children or are saving for a large goal like a house or car, your savings account might swell beyond this initial three to six months of net pay because the future isn’t so certain or you need to have cash funds more readily available.

Checking Accounts FAQ

What is the difference between APR and APY?

Both your annual percentage rate (APR) and annual percentage yield (APY) calculate interest. APR measures the interest a bank will charge you for borrowing its money, and APY is the amount of interest you can earn on your investments.

What should I consider before opening a checking account?

Before devising a plan on where to place your money, you first need to have a clear idea of how much you actually spend in a month and compare it to your income. You should account for major expenses like rent, bills, and loans. Then take a look at what you spend on food, gym memberships, monthly subscription services, and any other funds you use to simply enjoy your life. After unearthing this number, you then need to add a little more as a buffer for any extra expenses.

Is there a limit to how much I should keep in my bank account?

At the end of the day, this is really up to you. Having more than that little extra in your checking account means you’re leaving money on the table. Checking accounts generally earn less interest than savings accounts (check out our best savings account review for reference). The more money you leave in your checking as opposed to your savings means the less money you’ll earn back in interest savings over time.

The Best Checking Accounts: Summed Up

Other Banking Reviews

We’ve covered all the bases for you when it comes to saving, spending, and earning. Read on:

You might also like

Tesla’s Midsize Model Y Starts at $39,000, but Pricier Versions Will Come First

March 14, 2019 | Automotive

How Millennials Can Improve Their Credit Score

April 04, 2019 | Credit & Lending

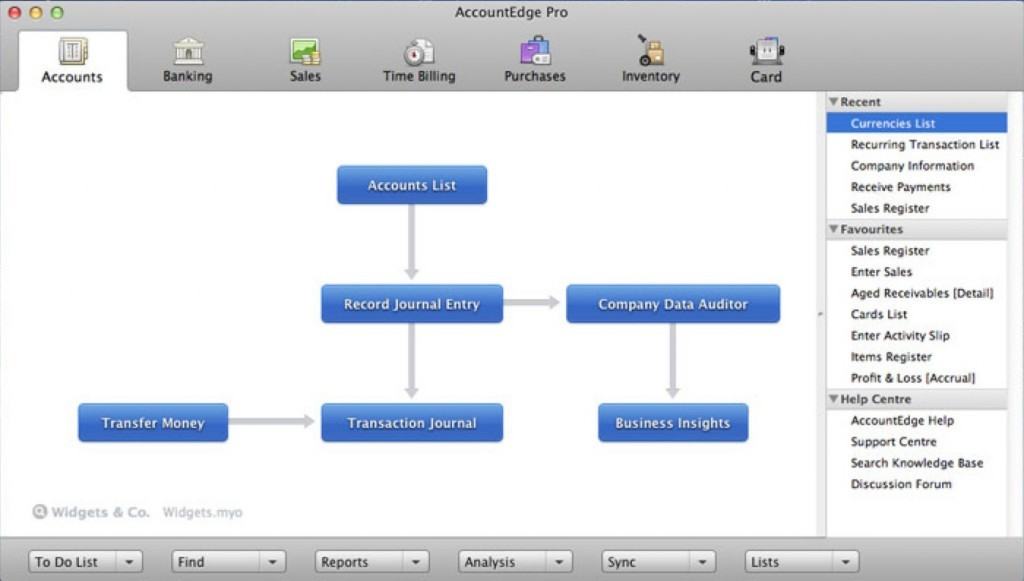

CheckBook Pro for Mac helps you track your finances with a variety of tools, many of them offering efficient access to your financial information. It is designed to import information directly from other sources, including your financial institutions and Quicken Essentials for Mac. You can also manually input transactions, reconcile them, add scheduled deposits and debits, and create a graphic overview of your accounts. The app supports working with multiple accounts and allows you to track where the money comes from for each transaction.

Once you install CheckBook Pro, you can open it from the Launchpad. Begin by naming your account and importing the information or entering a beginning balance. New transactions are easy to add using the buttons at the top of the page. Move between different views with the buttons below the ledger. The summary tab lets you view various reports, including your expenses, income, and tax-deductible items over various time periods. There are multiple tutorials available from the Help menu to introduce you to the wide range of features this app offers, although they don't pop up automatically when you open the app for the first time. Password protection for each account is available but not mandatory.

While you can try CheckBook Pro free for five days, you must purchase a license for $24.95 to continue using it beyond this period. While this app is comparable to various other money-tracking programs available, it does operate smoothly and offer a streamlined interface.

Home Checking Account Software

Editors' note: This is a review of the trial version of CheckBook Pro for Mac 2.5.4.