Personal finance software can help you to manage your money flow in a better way. Money management is the most critical task in both personal and business life. For helping the business owners and personal finance management, there are many finance software is available for Mac.

The budgeting apps are smart enough to send notifications to any unusual bank and credit card activity in real time. In addition to this, these finance managing software tools can notify you of any interest charged on credit cards and bank accounts. There are free personal finance software apps and premium budget software for finance management. Free budgeting software is also good enough to record and summarize your cash flow and help to manage your personal or business budget in every month.

The software also lets you view your budgets by a variety of time periods (monthly, annually, and so on). Setting goals, like trying to establish an emergency fund, isn't rocket science. Free Budget Calculator When it comes to personal finance, it's best not to play the guessing game. Sometimes the easiest way to manage your monthly budget is to visualize it.

Here is a list of best personal finance software for Mac to get the centralization and overview of spending habits.

Banktivity 5

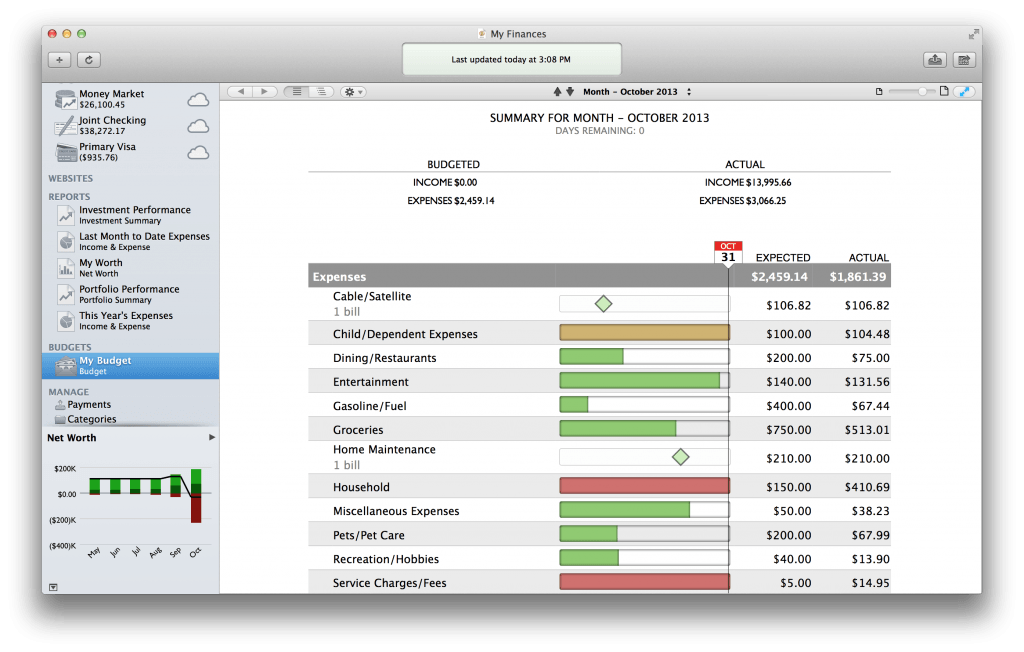

Banktivity formerly known as iBank 5, is one of the best personal finance software for mac in Apple Store. YBanktivity finance management software is the best choice for those who want to track transactions and manage the personal finance, that is better than simple accounting software.

This Mac budget software can connect more banks and credit card accounts than other free software. The Banktivity Mac app can get enhanced investment support for bonds and offers dismissal of similar transactions from the bank data downloads. You can acknowledge your mistakes by comparing the past, current or projected projects.

Related: These iPhone Apps will Earn Money back While You Shopping.

Through Banktivity cloud sync, you can sync your banktivity files on more than one device for free to get access to them whenever you want to. The app effortless manages your transactions, allowing control over the budgets, stock portfolios, etc.

Download: Mac $64.99 | iPad $19.99

2. MoneyWiz 2 – Personal Finance

MoneyWiz 2 allows you to efficiently control all your financial transactions, making this budget software a top choice among all the personal finance software for Mac. This finance software allows you to import the data from other apps and ensures a smooth run due to its sleek and sturdy interface.

MoneyWiz automatically monitors your financial transactions and assigns them in the needed budgets and build custom reports based what you acknowledge regarding your money. MoneyWiz 2 budget software is there to assist in online banking, downloading all your transactions and you can use any file on it from CSV, QIF, OFX, QFX to MT940 file.

Related: A Complete Guide to Transfer Money Online with Email for Free

Make your transaction entry to be fast with the software. The finance software is helpful in budget tracking and protects your data with a PIN which can be set for a particular time period. The PIN will auto-erase on 10 wrong attempts for maximum security and comfort.

Download: Mac $24.99 | iPad $4.99

3. Debit & Credit – Personal Finance Manager

Looking for a personal finance software, that offers convenience and at the same time has the needed features, then Debit & Credit software is the right choice for you. With this budget software, you can easily reconcile your accounts with the bank statements for eliminating any disparities and getting the extra help to keep the accounts in shape.

Create a new transaction in a matter of seconds and save the locations of the places where you go often, helping you to record the expenses easily. Get clean and crisp reports along with Split categories, pending transactions, transaction export, file attachments (with sync), transaction tags. Debit & Credit Mac software comes in eight color themes available for selection in the settings of the software allowing you to customize your experience.

Related: 3 Free Smartphone Budgeting Apps to Monitor Finance Transactions & Alert

Download: Mac Free | iPad Free

4. Moneydance 2015

Moneydance is one of the best personal finance software for Mac handling multiple currencies and doing any financial task virtually with ease. This Mac Budget Software has more reporting options than the majority of other software inherits; giving you centralized access to all the data related to your financial transactions.

Follow your investments and focus more on your portfolio through the software. Never miss a payment by scheduling for single or recurring transactions. Send online payments quickly and attach images, PDFs, and other such files to transactions. It learns how to categorize the downloaded transactions automatically. Create and control your budget like a breeze also ensures the inflow as well as the outflow of money through Moneydance.

Download: Mac $49.99

5. Ms Finance

Standing out from the crowd, Ms Finance is there to solve all the troubles encountered with the previous personal finance software. The app makes the tracking and paying off bills convenient by bringing them at a single place.

It handles multiple accounts with the support for the transfers between same currency accounts. Create custom reports to show any financial data virtually through the report assistant. Forecast your financial requirements for the future through Ms Finance. Get accurate statements regarding the balances of your account to get the needed help. The developers of the software have tried to make the design and user interface to be intrusive and simple as possible to allow the user to access the features easily.

Download: Mac $14.99

6. Quicken 2

Quicken is well known for financial management and offer iPad and Mac software. This Finance Management Software can import all your bank transactions safely & automatically. This excellent software can automatically categorize your spending. The additional features like portfolio performance, make informed buy/sell decisions and find funds that fit your goals are nice features to make this one of the best finance software.

Quicken automatically generates bill reminders and pay your bills with Quicken Bill Pay and offer investment tracking, offline use & enhanced search

Download: Mac $74.99 | iPad Free

7. iFinance 4

iFinance is a personal finance software inheriting some great features, making it worth a try. You can easily compare your investments to the rest of the market. It is a good program that can easily handle the transactions of varying forms.

The Mac finance software analyzes your finances and maintains its records through Cloud Sync or Wi-Fi. It gives the users easy to customize charts as well as reports; iFinance 4 clearly arranges the transaction lists of all your financial resources, group different types of expenses.

Download: Mac $29.99

Know how the assets perform with the reports made by the tool. iFinance offers the user a broad range of easy to customize charts and reports giving you the precise reports on the source of money and the spending without any trouble.

Best financial software must have the capability to securely connect all your bank accounts and credit cards in one place. This software can track your income and expense in real-time and advice to manage the budget and invest the money in diverse ways in the coming future. In addition to this, these financial software tools summarize all your monthly expenses and automatically set budget for each category to limit your spending.

Best Free Budget Tool For Mac

Related: This is How You Can Convert Your TV to Smart TV Under $99 Budget

Through with these personal finance software for Mac, you can track your expenses and the balances of your account for the best management of money and credit cards. With efficient management of money, you can get early warnings regarding the upcoming financial fines, interest payments, and bills.

Best Personal Finance Software 2019 - Programs for Mac, Windows PCs

We spent over 60 hours testing 20 personal finance apps and programs to find the best budgeting and money management tools. Our choice for the best personal finance software is Quicken Premier. It combines the best budgeting tools with easy-to-use tax reporting. It can track your investments by letting you compare your portfolios with the market, as well as allowing you to track fund fees and set retirement goals. Quicken Premier is the most complete program we reviewed and a good choice for anyone looking to get a better handle on their finances.

Best OverallQuicken Premier

Quicken Premier connects quickly to your bank accounts and easily tracks your spending and your investments. It offers useful budgeting tools like online bill pay and budgeting alerts.

Best ValueQuicken Starter

When looking at the number of features available versus the cost, we found the Quicken Starter hits the sweet spot. It has the same budgeting tools as Quicken Premier but doesn’t track investments.

Best Mobile AppBuxfer

Buxfer is the best mobile app we reviewed. It’s incredibly easy to keep track of your spending and set up alerts for when you deviate from your budget. It is one of the easiest programs to use that we reviewed.

| Product | Price | Overall Rating | Connectivity | Budgeting | Reporting | Personal Investing | Noteworthy Feature | Best For | Options & Functionality | Bank & Credit Union Accounts | Credit Card Accounts | Investment & Retirement Accounts | Works on PC & Mac | Browser-Based | Mobile Apps | Budgeting Simplicity | Online Bill Pay | Budget Alerts | Track Remaining Budget | Copy Budget to Next Month | Goal Tracking | Net Worth Overview | Spending Reports | Cash Flow Reports | Personal Investing Reports | Tax Reports | Export to Tax Program | Portfolio Overview | Track Performance | Display Asset Allocation | Compare Portfolio to Market | Track Fund Fees | Retirement Goals | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Quicken Premier | View Deal | 4.5/5 | 8.3 | 10 | 10 | 10 | Portfolio X-Ray | Investment Management | 100% | 100% | ✓ | ✓ | ✓ | - | - | ✓ | 100% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | PC Only | ✓ | ✓ | ✓ | ✓ | PC Only | ✓ | ✓ | ✓ |

| Moneydance | View Deal | 4/5 | 8 | 8.3 | 8 | 6 | P2P Lending Accounts | Reporting | 80% | 85% | ✓ | ✓ | ✓ | ✓ | - | ✓ | 100% | ✓ | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | ✓ | - |

| Buxfer | View Deal | 4/5 | 10 | 7.5 | 5 | 4 | Links to PayPal | Forecasting Budget | 100% | 70% | ✓ | ✓ | ✓ | ✓ | ✓ | Android, iOS & Windows | 100% | - | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | - | - | ✓ | ✓ | ✓ | - | - | - |

| Quicken Starter | View Deal | 4/5 | 7 | 9.5 | 7.8 | 1.3 | Snap & Store Receipts | Simple Budgeting | 100% | 100% | ✓ | ✓ | - | PC | - | ✓ | 100% | ✓ | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | ✓ | - | - | - | - | - | - | - |

| Banktivity | View Deal | 3.5/5 | 7 | 7 | 9.3 | 4 | Apple Watch App | Reporting | 90% | 80% | $ | $ | $ | Mac | - | iOS | 100% | ✓ | - | ✓ | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | - | - |

| CountAbout | View Deal | 3.5/5 | 9.8 | 5.8 | 5.5 | 3 | Customizable Categories & Tags | Simple Budgeting | 100% | 80% | Premium | Premium | Premium | ✓ | ✓ | ✓ | 80% | - | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | - | - | ✓ | ✓ | - | - | - | - |

| Mvelopes | View Deal | 3.5/5 | 9.8 | 6 | 5.5 | 1 | Financial Coaching | Envelope Budgeting | 100% | 80% | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 75% | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | - | - | ✓ | - | - | - | - | - |

| Moneyspire | View Deal | 3.5/5 | 7 | 7.5 | 5.3 | 6 | Print Checks | Paying Bills | 75% | 75% | Plus | Plus | Plus | ✓ | - | iOS | 80% | Plus | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | - | - | ✓ | ✓ | ✓ | - | ✓ | - |

| YNAB | View Deal | 3.5/5 | 8 | 7 | 4.8 | 1.3 | Works with Amazon Alexa and Apple Watch | Budgeting | 75% | 65% | ✓ | ✓ | - | ✓ | ✓ | Android, iOS & Amazon Echo | 100% | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | - | - | - | - | - | - | - | - | - |

| BankTree | View Deal | 3.5/5 | 7.5 | 5.3 | 6.3 | 9 | Supports Multiple Currencies | Investment Management | 75% | 80% | $ | $ | $ | PC | - | ✓ | 70% | - | - | ✓ | ✓ | - | ✓ | ✓ | ✓ | ✓ | - | - | ✓ | ✓ | ✓ | ✓ | ✓ | - |

| iFinance | View Deal | 3/5 | 6.3 | 7 | 5.5 | 3 | Apple Watch App | Tracking Multiple Budgets | 65% | 80% | ✓ | HBCI support required | ✓ | Mac | - | iOS | 80% | German banks only | ✓ | ✓ | ✓ | - | ✓ | ✓ | ✓ | - | - | - | ✓ | ✓ | - | - | - | - |

| MoneyLine | View Deal | 3/5 | 6.3 | 4.8 | 6.3 | 2 | Transaction Management | Simple Budgeting | 75% | 80% | ✓ | ✓ | ✓ | ✓ | - | - | 90% | - | - | ✓ | - | - | ✓ | ✓ | ✓ | ✓ | - | - | ✓ | - | ✓ | - | - | - |

Best Overall

Quicken Premier

Our pick for the best personal finance software is Quicken Premier. Quicken is one of the most well-known names in personal finance, and it is constantly updating its software with new features.

The version of Quicken Premier we tested was incredibly easy to connect to any bank to track finances.

When you connect the program to your account, it will import your transactions and categorize them automatically. If something is incorrect, you can edit it. The categories are used to help you organize your budget. Quicken color-codes your budget, green for within budget and red for over budget. The program sends alerts when you approach or exceed your budget. Quicken gives you multiple options for setting up your budget. You can keep the same limit each month, or direct any unused amount to roll over into the next month.

Where Quicken Premier stands out is in its tools for managing investments. If you own stocks or other securities, this is the best choice for you. Its tools analyze your portfolio and compare its performance with the market. You can also create retirement goals and use the calculator to evaluate your finances and determine what you need to save toward your retirement goals.

Best Value

Quicken Starter

Quicken Starter is a scaled-down version of Quicken’s personal finance software. With a cost of $39.99, this is among the lowest-cost programs we reviewed.

This is our best value option because it gives you the same useful budgeting tools as Quicken Premier.

Quicken Starter connects directly to your accounts and imports your balances and transactions, automatically categorizing them. You can manually adjust the categories if default tags don’t match your budget.

Budgets are easy to create and can be divided into categories to track how much you spend on groceries, rent and other items. You can set up email or text alerts for when you approach or exceed your budget limit in a certain category. The Quicken mobile app also lets you check on your budget from your phone. You can also use the app to take pictures of receipts and add those to your records.

Quicken Starter has no tools for monitoring or tracking your investments. You can’t import information about your investments or use any of the tools for tracking fees or creating retirement savings goals. If you just want a personal finance program to track your spending and manage a budget, not having those investment tracking features shouldn’t be a deal breaker.

Best Mobile App

Buxfer

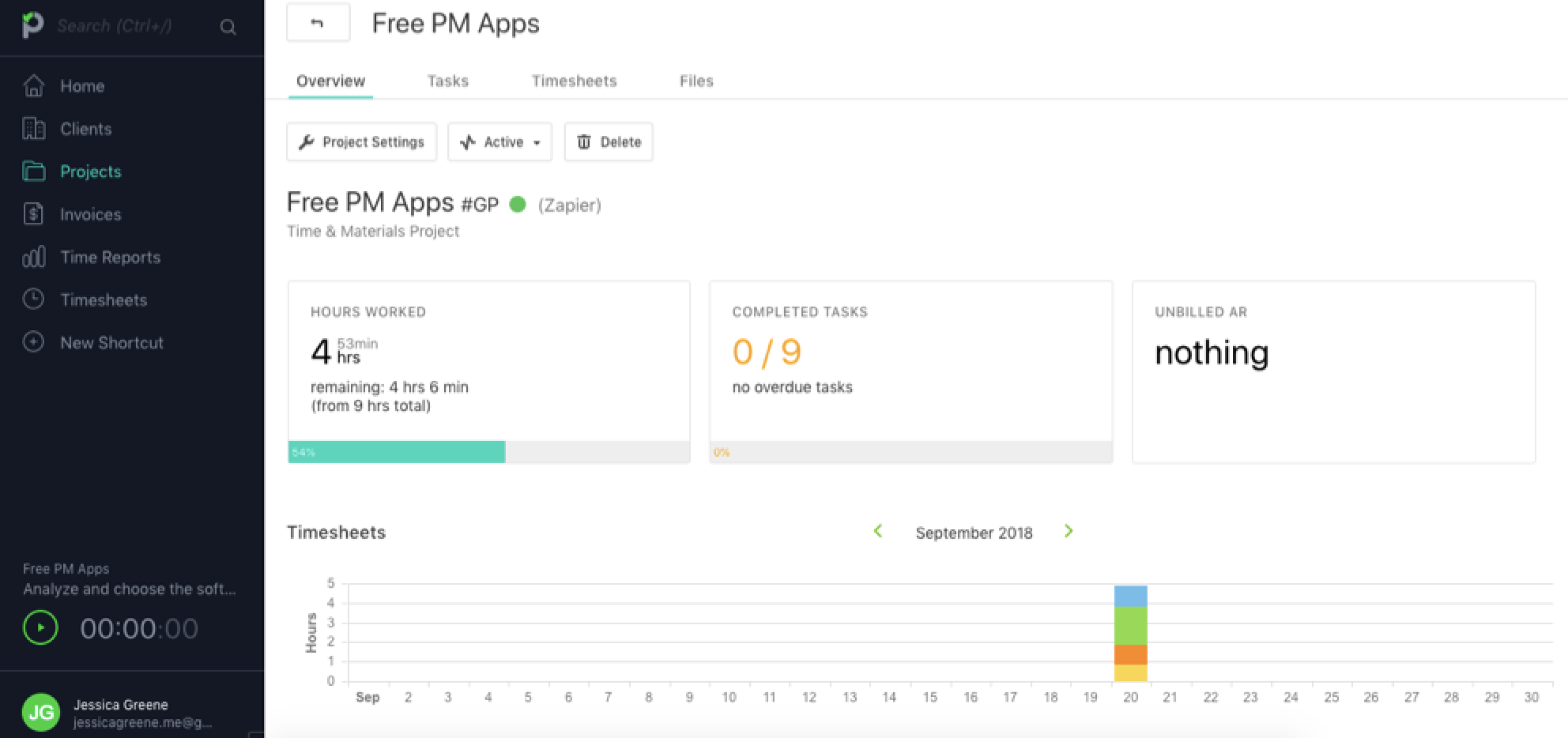

Buxfer PilotHaving a mobile, web-based personal finance program makes it easy to track your spending and expenses from anywhere.

/picture-36-583bd29f5f9b58d5b1902d52.jpg)

Once you create an account with Buxfer and download the app, you can connect it your bank and credit card accounts. Once connected, your balances and transactions are added to Buxfer and automatically categorized. You can also edit the information if the automatic categorization isn’t accurate.

Creating a budget with Buxfer is easy. You set an overall spending limit for each week, month and year you intend to budget. You can use the categories to further refine your budgeting. The budgets are color-coded. One advantage of being primarily app-based is that you can always have your budget available and reference it when you’re out shopping. Buxfer also has shared-expense tracking, which lets you send money to others, especially useful if you split rent or utilities with roommates.

Buxfer offers simple reports that help you visualize your spending. You can use the pie charts to determine what percent of your income you spend on various categories. Line graphs give you a quick view of your income versus your expenses. One drawback of Buxfer is that you can’t set up savings or retirement goals.

Best for Investors

Moneydance

Best Free Budget Program For Mac

If you have investments and brokerage accounts, Moneydance is one of the best options for you.

This program has tools to help you track your investments and monitor the progress of your portfolio. It syncs to your brokerage account and shows your balances and trades. In addition, it has reports that let you track your transactions and the performance of your investments. Moneydance is an easy-to-use program that lets you categorize your spending so you can see how much you spend and what you spend it on. You can also sync to your bank and P2P lending accounts to directly import your transactions.

Best for Envelope Budgeting

Mvelopes

Mvelopes BasicFree Budget Program For Mac

Mvelopes is one of the best programs if you practice envelope budgeting.

With this method, you split your budget into envelopes marked with categories such as groceries, bills or entertainment. You then purchase items with money from the envelope category they fall under. Mvelopes lets you track your expenditures by assigning them to digital envelopes. When you exceed a spending limit, the envelope balance changes to red, and the program prompts you to address the situation by adding funds or letting it stay negative. This is a good way to visualize your spending and track where your money goes. One drawback is it doesn’t send you an alert when you go past a limit.

Why Trust Us?

We’ve reviewed personal finance software for 12 years. For this most recent update, we spent 60 hours using 20 programs before settling on the best 10. You may notice that some newer apps don’t appear in our reviews. We chose not to include free services like Mint or Personal Capital, though we may reconsider in future updates.

We did look at both of these programs. Mint is one of the most popular personal finance apps. It also offers a free credit score and has a wide range of alert options. Personal Capital doesn’t have budgeting tools, but it lets you track all your accounts and is very well-suited to people with investments they want to track.

How We Tested

To test these programs, we purchased or downloaded complete trials and used them to create budgets, connect to a bank account and monitor how well each program performs. We found that setting up your budgeting software can take some time, so be sure to give yourself an hour or possibly more. The best programs connect automatically to your bank, credit card or investment accounts directly. A few require you to import through Dropbox or another intermediary. Our Options & Functionality Score reflects this; anything with an 80 percent or above is easy to connect.

Once our transactions were imported, we let the program categorize them for us and began creating budgets. We noted the tools each program has to simplify the budgeting process, and whether you can copy the budget from month to month and set up recurring payments.

To make sure we tested these programs for all manner of financial scenarios, we also looked at the tools for monitoring investments. Many of the programs at least give you an overview of your portfolios and track their performance. The more extensive personal finance programs allow you to compare your portfolio to the rest of the market.

How Much Does Personal Finance Software Cost?

Personal finance software can cost as little as nothing or as much as $130 – much depends on what you want your software to do and if you prefer using an app, an online portal or a program downloaded to your computer. There are free apps like Mint and more robust apps like You Need A Budget, which costs $6.99 a month. If you have investments or need more complicated budgeting and accounting tools, a program you download may be your best choice. These usually cost around $50 to $130.

Best Free Home Budget Software For Mac

How to Choose a Personal Finance Software

Before settling on a personal finance program, take stock of what you need it for and how you’ll use it. Everyone’s financial situation is different, and some of these programs may not suit all your needs.

Basic Budgeting

If you need to get a handle on your finances and track your spending, each of these programs offer something for you. A budget can be as simple or complex as you need. You may want to simply track your total spending, or you may want to divide it into a range of categories. Some people like the envelope budgeting method, which allows you to set aside money each month for specific items or goals. Mvelopes is a good program that utilizes this method.

Goal-oriented Budgeting

If you’re budgeting because you want to save toward a goal, say a down payment on a home or for retirement, many of the programs offer tracking tools that let you set aside an amount each month and track your progress. Using personal finance programs to manage your budget can help you find areas you’re overspending in or ways you can cut back your spending to make your goals.

Tracking Investments

Not everyone invests money in the stock market, but if you do, you’ll need a program that can cover the full breadth of your financial picture. Many of the programs we tested integrate with your financial firm and can at least give you a top-level look at your portfolio. The best let you track your performance and compare your portfolio with the market. If investment tracking isn’t what you need, you can find a lower-cost program with the budgeting features you’re looking for.

Best Free Personal Finance Apps

Most of the personal finance programs we reviewed cost money to download or sign up for, and a few have monthly subscriptions. If you’re just starting to budget and track your finances, take a look at some of these free apps:

Mint: This is a free budgeting app developed by Intuit, the same company responsible for Quicken. Mint is free to download and use. Once you install it, you sync it to your bank and credit card accounts, and it pulls all that information into one main dashboard. Mint categorizes your transactions, so you can check your bank and credit card balances at a glance. It even goes a step beyond and lets you check your credit score and investment performances as well as your home’s value.

Mint automatically creates a budget for you, though you can adjust it depending on your needs. You can also set up alerts to tell you if you’ve gone beyond your budget or have a bill coming up. One drawback of using a free app like Mint is you get ads and promotional offers.

Clarity Money: This is a relatively new app, owned by Goldman Sachs. It's very similar to Mint in that it syncs to your bank accounts, tracks spending and sends alerts when you have a bill due. However, it stands out by monitoring your subscriptions to services and websites, and it can cancel them for you. Clarity Money gives you a good picture of your finances, but if you need more in-depth budgeting tools, it may not be as useful.

PocketGuard: This is a basic app that tracks your spending. It doesn’t have many additional features and may not be good for reconfiguring your entire budget, but it’s a useful way to see how much money you have on hand.